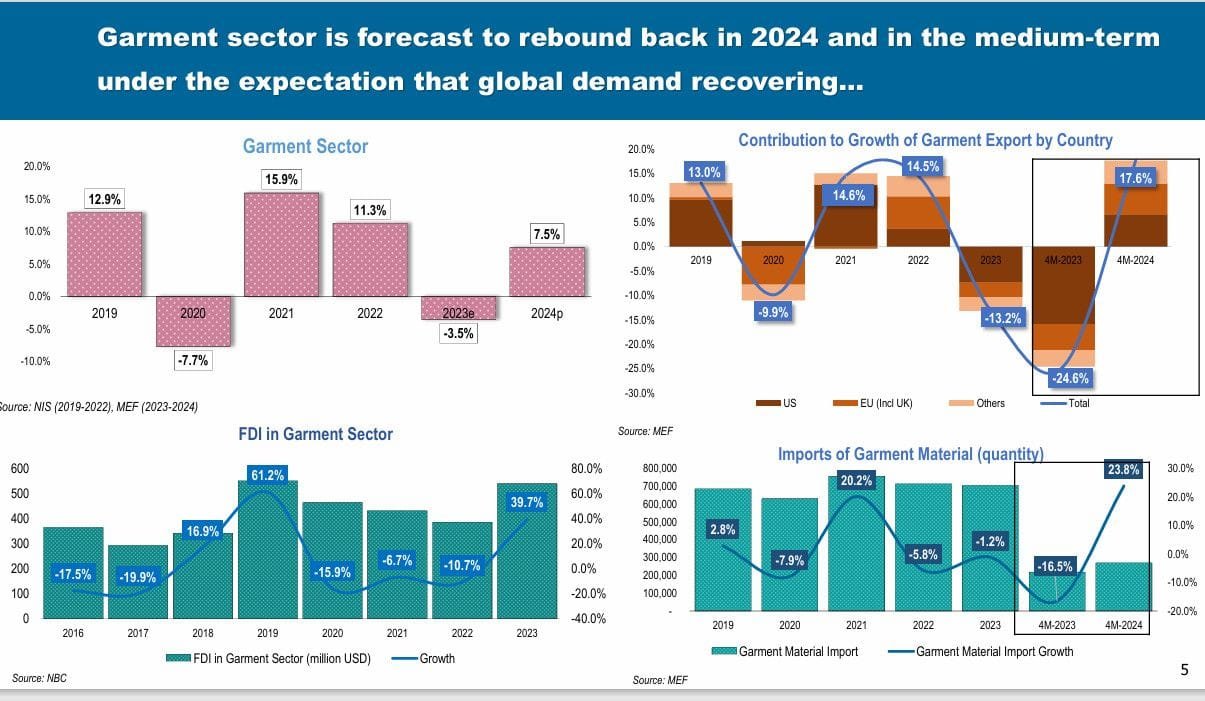

Cambodia’s economic diversification has become urgent as the garment sector faces EU tariff risks and global competition. Garments once powered 25% of real GDP and were part of an export base where five products made up 80% of total shipments. Today, leaders know this model is too narrow. Industry now drives 35% of GDP in 2024, and new momentum is coming from assembly lines and wiring harness production linked to Thailand and Vietnam’s automotive supply chains. Growth for 2024 and 2025 is projected at 5.8% and 6.1%, fueled by these higher-value activities.

Cambodia’s Economic Diversification Through the Auto Link

Cambodia is moving fast to support Thailand’s massive car industry. Border Special Economic Zones are attracting investments from firms that produce auto-parts, electronics, and wiring harnesses. Svay Rieng alone secured 13 projects tied to Vietnam-linked trade routes, while Kampong Speu recorded 19 new industrial investments in early 2025.

These zones give Cambodia direct access to regional value chains. Proximity allows suppliers to deliver quickly and cheaply, while firms gain relief from congestion and rising labor costs in Thailand. For Cambodia, this shift signals a long-term break from low-skill garments toward light manufacturing that has stronger global demand.

Solar Manufacturing is A New Driver in Cambodia’s Economic Diversification

Solar panel assembly is emerging as a bright spot. Foreign investment in renewables is rising, matching government plans for green transformation and industrial upgrading. Solar assembly supports broader diversification because it requires cleaner processes, new materials, and more technical labor.

The push toward solar also strengthens export capacity. As global buyers demand cleaner supply chains, Cambodia sees an opportunity to build a new reputation in climate-aligned manufacturing. This stream of investment stands in clear contrast to the older garment model, which is now vulnerable to external policy shifts such as EU trade measures.

Read Also: Cambodia Energy Deal Watch: When Politics Threaten Progress

Skill Development: Preparing Workers for Higher-Value Production

To make these new industries succeed, Cambodia is investing in people. Vocational training programs are expanding rapidly to meet labor needs in electronics, wiring, and assembly. Training centers are preparing workers for automation and light-industrial processes that require more precision than traditional garment lines.

Government incentives focus directly on these skills because they are essential for long-term competitiveness. With services at 42% of GDP and agriculture at 23%, stronger technical training ensures the manufacturing sector can anchor future growth and support the wider labor market.

Cambodia’s Economic Diversification and The Turning Point for Investors and Policy Makers

Cambodia’s shift from garments toward auto-parts, electronics, and solar assembly reflects a structural transformation. Export diversification accelerated after COVID-19, and Q1 2024 data shows clear movement toward higher-value production. This transformation is the core of the economic diversification in the country and positions Cambodia for a more resilient future.

Read Also: Resetting Goals in Cambodia Textile Export Strategy 2025

For deeper insights into Cambodia’s economic diversification, investors can connect with Market Research Cambodia by Eurogroup Consulting. Leveraging 40 years of experience, the firm excels in strategic consulting and market research in the region. Its dedicated team offers unmatched guidance and data-driven clarity, making it the ideal partner for navigating Cambodia’s fast-changing industrial landscape.