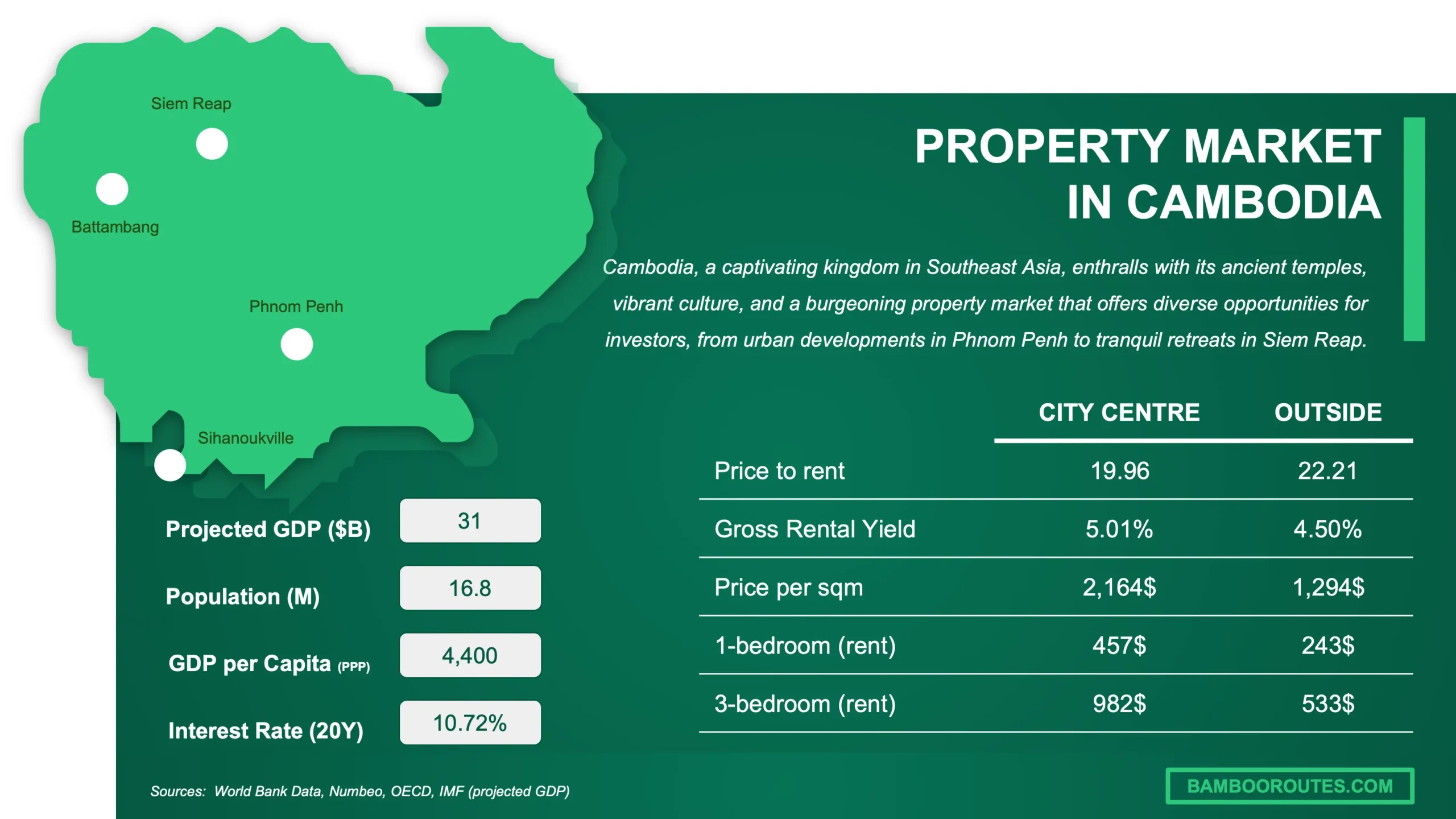

Cambodia’s property market is undergoing a reset. In 2025, the total value is projected to reach USD 619.55 billion, driven largely by residential developments. The capital, Phnom Penh, now offers entry-level condos at USD 1,500–2,200/m², roughly 15–20% below peak 2019 prices. These Cambodia Property Market 2025 trends highlight major shifts in demand and pricing amid slow recovery.

Residential Recovery vs Commercial Softness

In early 2025, developers launched nearly 3,900 new mid-range condo units, signaling strong confidence in affordable housing. Residential activity revived with modest price gains, with Phnom Penh saw a 1.72% increase in 2024. This happened though real inflation-adjusted values stayed flat.

By contrast, the commercial sector remains weak. Office occupancy stands at ~64%, and retail occupancy at 58.6%. Luxury condos also saw declines, with high-end units dropped 2.21% to USD 2,650/m² in 2024.

Cambodia Property Market 2025: Investment Appeal in Housing

Despite corrections, the residential rental market remains appealing. Rental yields for apartments hit between 7.13% and 8.16% in early 2025. With land prices stabilizing, many developers and investors now focus on affordable housing as a resilient opportunity.

Financial sentiment also shows caution. Bank deposits are rising, liquidity remains locked, but recent interest rate cuts have helped restore buyer confidence.

Industrial Momentum and Logistics Investment

Another bright spot is the industrial and logistics sector. Despite a softer commercial sector, construction approvals worth around USD 3 billion in early 2025 point to strong infrastructure expansion. This supports growing demand from Cambodia’s export and manufacturing sectors.

Read Also: Select Cambodia Digital Service Growth Surges with Mobile Boom

With 2.9 million tourist arrivals in early 2025, mostly from Thailand and Vietnam, the logistics pull is clear—better connectivity fuels demand for hotels, retail, and urban transport hubs.

Read Also: Cambodia Tourism Industry Recovery and the Road Ahead

Digital Infrastructure and Smart Urbanization

Cambodia’s real estate reset is also linked to modernization. While specific digital infrastructure data is limited, government push toward smart urban development and digital logistics platforms indicates a shift in the market. Investors and developers increasingly see smart systems as core to long-term property value.

Read Also: The Untold Impact of Cambodia Infrastructure Connectivity

Economic Context and Outlook for Cambodia Property Market 2025

Cambodia’s GDP growth was revised down—from 5.5% to 4% in 2025—reflecting US tariffs of up to 36% on Cambodian exports. These trade pressures influence confidence in industrial-sector investment.

Still, experts remain cautiously optimistic. Growth is expected to rebound to 6.1% in 2025 and 6.5% in 2026, driven by urbanization, rising wages, and domestic consumption. These fundamentals support sustained demand for affordable housing and smart city infrastructure.

The Path Forward

In summary, Cambodia Property Market 2025 is defined by a reset: moderating prices, selective sector strength, and renewed developer focus on affordability and industrial growth. Investors seeking long-term stability should consider well-located, future-ready residential and logistics-linked assets.

The reset offers opportunity for those focusing on value, sustainability, and demographic trends that underpin Cambodia’s urban growth.

Frequently Asked Questions (FAQs)

Q1: What sectors lead Cambodia’s property market recovery?

A: Affordable and mid-range residential dominates, while commercial real estate remains soft.

Q2: How attractive are rental yields in Phnom Penh in 2025?

A: Yields range from 7.13% to 8.16%, making housing a steady investment option.

Q3: Are industrial and logistics developments still growing?

A: Yes, USD 3 billion worth of construction approvals signals growth despite broader corrections.

Q4: What economic risks does Cambodia face in 2025?

A: Lowered GDP forecasts (4%) and trade uncertainty, including US tariffs, affect investor confidence.

Q5: Why is digital infrastructure important in the market research for Cambodia Property Market 2025?

A: Smart logistics and IoT-driven urban projects are viewed as long-term value boosters in evolving real estate.