Cambodia is undergoing a digital finance revolution, and at the center of this shift is the Cambodia mobile payments surge. As of June 2025, there were 20.2 million registered e-wallet accounts. This is an interesting number because it’s more than the country’s population. Furthermore, it reveals just how quickly Cambodians have adopted mobile payment tools in their daily lives.

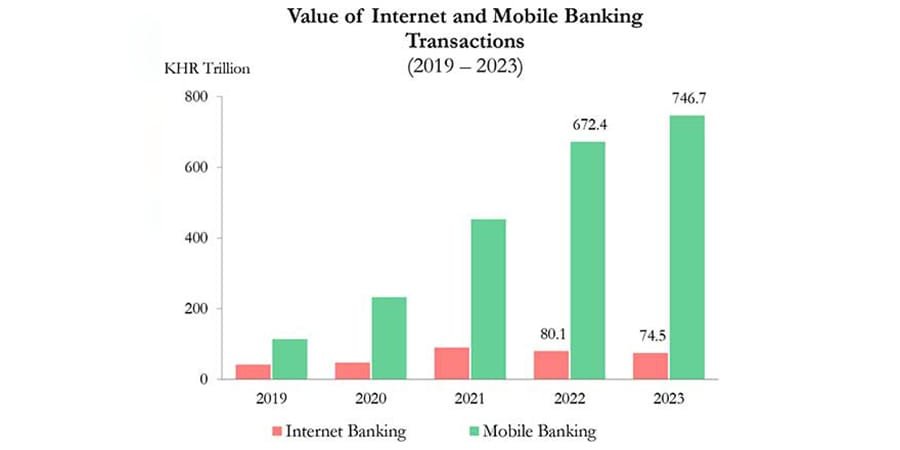

The volume of mobile payment transactions skyrocketed from 211.2 million in 2022 to 333.7 million in 2023, a growth of 58.1%. Even more striking is the rise in transaction value. In just one year, digital wallet transactions almost doubled, reaching $58.2 billion in 2023 or up 98.3% from the year before. This reflects the increasingly central role that mobile payments play in both retail and broader economic activities.

KHQR and Bakong: Laying the Foundation for Cambodia Mobile Payments Surge

A major driver of this growth is Cambodia’s integrated QR code ecosystem. The KHQR system, launched by the National Bank of Cambodia, supports standardized QR code payments across banks and payment providers. In 2023, KHQR processed over 601.3 million transactions, a 28.7% increase from previous years.

KHQR works in tandem with Bakong, Cambodia’s blockchain-based central bank digital payment infrastructure. These innovations have not only streamlined domestic transactions but also gained international attention. Neighboring countries are studying Cambodia’s model as they look to build similar systems for their own economies.

Read Also: Cambodia QR Code Payment Integration Soars and Powers Trade

Mobile Penetration Powers Payment Innovation

Another key factor behind the Cambodia mobile payments surge is mobile accessibility. By early 2025, Cambodia had 25.3 million mobile connections, or 143% of the total population. With more devices than people, the infrastructure is primed for digital payment expansion.

Even more critical, 91.3% of mobile connections in Cambodia are broadband-enabled, offering fast and stable internet via 3G, 4G, or 5G. This reliable mobile internet backbone ensures that users across urban and rural areas can access mobile payment platforms with ease.

Read Also: Cambodia Digital Service Growth Surges with Mobile Boom

Cambodia Mobile Payments Surge: Cross-Border Growth and Government Support

Cambodia is not just advancing domestically, but it’s also going regional. The National Bank of Cambodia has integrated its payment systems with those of Thailand, Malaysia, Laos, Vietnam, and China, enabling cross-border QR payments and setting the stage for frictionless trade and tourism transactions.

The government is also investing in supporting infrastructure such as digital IDs, and strengthening regulatory frameworks that ensure consumer protection, financial stability, and open access for merchants. These efforts are designed to support long-term growth in digital payments.

Sustainable, Inclusive Finance in Cambodia Mobile Payments Surge

The momentum behind the Cambodia mobile payments surge shows no signs of slowing. As mobile payments continue to replace cash in daily transactions, Cambodia is moving toward a more inclusive, efficient, and transparent economy. The country’s digital payment strategy is not just about technology, but it’s about empowering people, businesses, and cross-border connections in a fast-changing region. With strong policy backing, high mobile penetration, and scalable QR technology, Cambodia is becoming a model for digital finance in Southeast Asia.