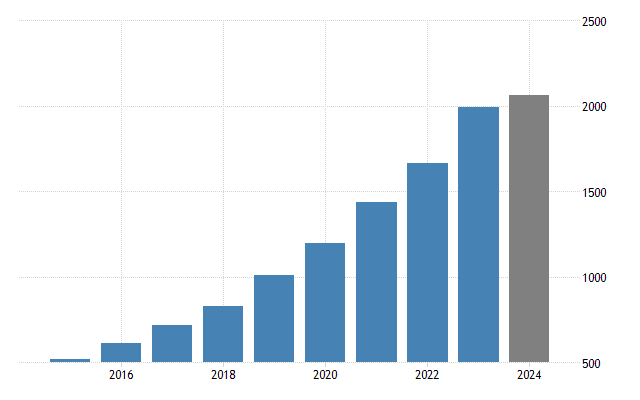

Cambodia’s mining industry is entering a transformative phase. In 2024, the sector generated nearly USD 100 million in non-tax revenue, a 79% increase from the previous year. This sharp rise reflects not only resource potential but also the growing impact of Cambodia mining regulatory reform.

Laying the Foundation: Cambodia Mining Regulatory Reform with Purpose

The National Policy on Mineral Resources 2018–2028, endorsed in 2019, set the tone for modernizing Cambodia’s mining sector. It aims to resolve long-standing issues in revenue collection, resource management, and environmental impact, aligning local regulations with international best practices.

In parallel, Cambodia’s Mining Law, originally passed in 2001, has seen multiple updates. The most significant include Sub-decree 72 (2016), which introduced stricter licensing rules and public engagement requirements. Under this framework, public forums are now mandatory for major mining decisions, promoting community transparency and accountability.

Revenue and Jobs: A Sector on the Rise

The results are already visible. In Kampong Speu province, 76 mining sites employed more than 1,600 residents in 2024. This local impact highlights the sector’s growing role in economic development and job creation.

On a national scale, mining’s contribution is set to grow. The Ministry of Mines and Energy projects that non-tax revenue, including mining, will form a major share of the government’s $1 billion revenue target for 2025.

Cambodia Mining Regulatory Reform: Investor-Friendly Reforms in Motion

One of the most significant changes is the drafting of a new mining law, modeled on the West Australian Mining Act. The key shift? A move from a contract-based system to a concession model, offering clearer guidelines and a level playing field for both domestic and foreign investors.

Analysts believe these changes will enhance legal predictability, making Cambodia a more attractive mining destination. The added transparency in business classification and licensing is expected to unlock new tax revenue streams and boost investor confidence.

Community Engagement and Environmental Safeguards

While Cambodia’s mining reforms aim to boost investment, the government is also addressing concerns about environmental and social impacts. New regulations now require Environmental and Social Impact Assessments (ESIAs) for all mining projects, with stricter enforcement of rehabilitation plans.

For example, in Ratanakiri province, a recently approved bauxite mine allocated $2.5 million for land restoration and community programs, including vocational training for affected residents. Additionally, the Ministry of Mines and Energy has launched public consultation forums in key mining regions like Preah Vihear and Mondulkiri, ensuring local communities have a voice in project approvals.

Mapping the Future: Asset Identification and Infrastructure

To support future growth, the government is also investing in mineral asset mapping. In 2024, the Ministry of Mines and Energy approved a budget exceeding USD 1 million for nine new exploration initiatives, designed to identify viable resource zones and fast-track project development.

This initiative not only helps investors identify high-potential areas but also enables the government to better manage and protect national mineral assets.

Cambodia Mining Regulatory Reform: From Reform to Results

The progress in Cambodia mining regulatory reform is already showing tangible results, and this can be seen in revenue, employment, and investor interest. With the rollout of clearer policies, stronger governance, and proactive asset mapping, the country is positioning itself as a sustainable and competitive player in Southeast Asia’s mining sector. As the nation continues to modernize its legal framework and build investor trust, the sector’s growth potential appears more promising than ever, balancing economic opportunity with responsible stewardship.

Have You Read:

The Market Potential Cambodia Mining Sector Outlook Has