The garment industry remains the backbone of Cambodia’s economy. It contributes more than a third of national GDP and makes up around 70% of total export earnings. But as global markets shift and competition rises, the sector is moving into new areas. Today, Cambodia garment export diversifies into sportswear and sustainable fabrics, aiming to secure growth in a fast-changing world.

Cambodia Garment Export Diversifies Record Exports Signal Strength and Resilience

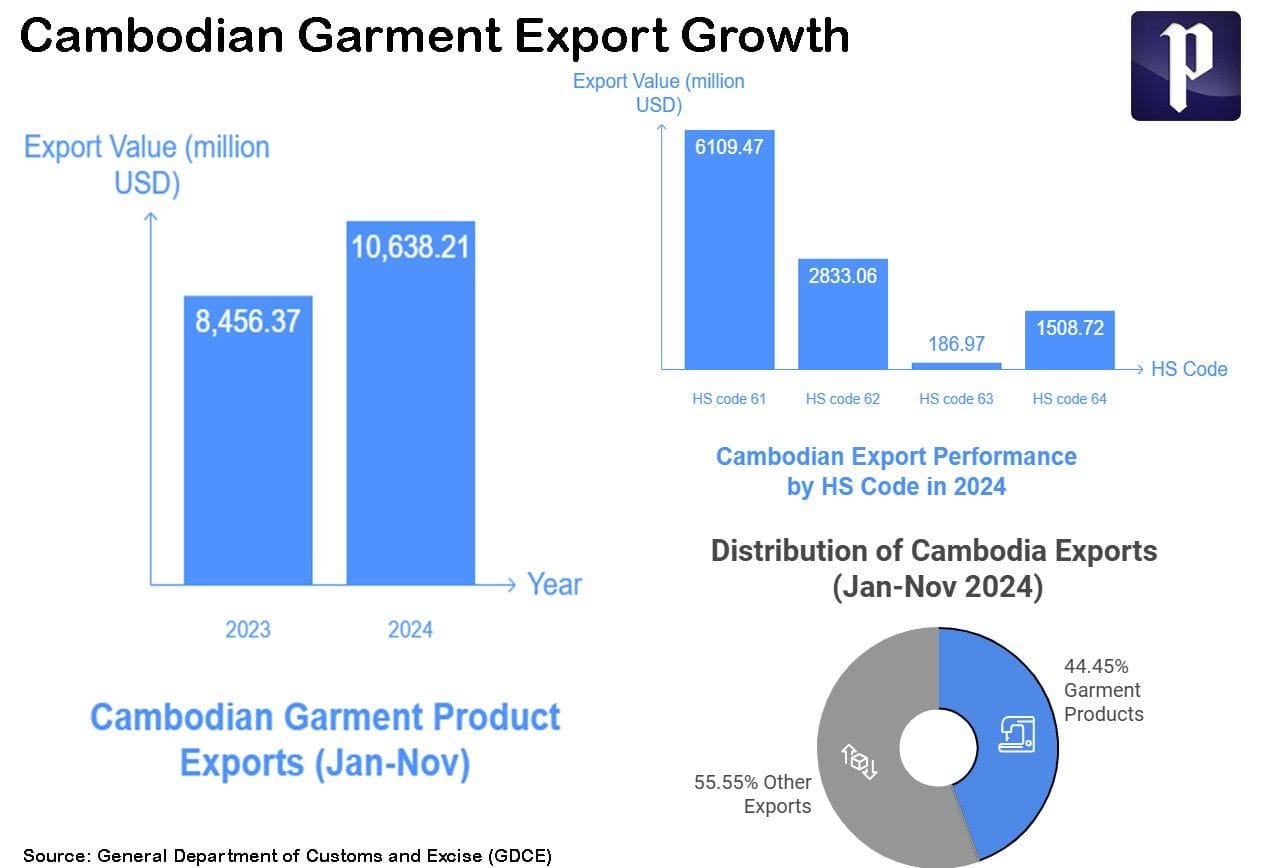

Cambodia’s garment, footwear, and travel goods (GFT) exports hit a record US$13.6 billion in 2024. This not only surpassed pre-pandemic levels but also reflected the country’s ability to adapt to global disruptions.

Trade tensions between the U.S. and China, alongside supply chain issues in Vietnam and Bangladesh, opened new opportunities. Cambodia seized this moment, expanding its share across most export destinations. This diversification has strengthened the sector’s global presence, proving its resilience in uncertain times.

Read Also: Cambodia Export Tariff Risk Threatens GDP Stability

Shifting Toward Higher-Value Products

For years, Cambodia’s garment industry has relied heavily on imported fabrics, with more than 60% sourced from China. New trade conditions now push the country to build more domestic capacity and add value locally. This shift encourages manufacturers to move beyond low-cost production and invest in higher-value garments.

The transition is also shaped by pressure from international buyers. Major brands want suppliers that meet ethical sourcing and sustainability standards. Concerns over forced labor and environmental impact have motivated Cambodian factories to improve practices and raise their competitive edge.

Sportswear and Sustainable Fabrics on the Rise

A big part of the transformation is the move into sportswear and eco-friendly fabrics. Global giants like Nike and Adidas are expanding sourcing from Cambodia, drawn by its willingness to align with sustainability and quality standards.

The global GFT sector is projected to grow by 2.6% annually from 2025 to 2029, with sportswear and women’s apparel leading the way. Cambodia’s pivot toward these segments positions it well to tap into rising consumer demand. Sustainable fabrics, in particular, offer a long-term growth path as global buyers continue to prioritize green and ethical production.

Global Shifts Create Opportunities

Geopolitical changes are also driving this diversification. U.S. tariff hikes on rival suppliers and instability in Myanmar have redirected sourcing strategies for many international companies. Cambodia, seen as more stable and increasingly adaptable, has become a stronger hub for higher-value garment manufacturing.

By diversifying into premium product lines and sustainable fabrics, Cambodia reduces its dependence on low-cost mass production. This positions the industry to compete on innovation, not just price.

Read Also: Resetting Goals in Cambodia Textile Export Strategy 2025

Cambodia Garment Export Diversifies: Challenges Ahead

Despite the progress, challenges remain. Supply chain disruptions, inflation, and shifting consumer demand could all weigh on export performance. Meeting sustainability standards requires significant investment in technology and workforce training. Still, the record-breaking exports in 2024 prove the sector’s ability to adapt.

Cambodia’s strategy of moving up the value chain offers a path forward. By combining competitive labor costs with higher-value production, the country is working to secure a stronger and more sustainable role in global apparel supply chains.

Looking Forward

Cambodia’s garment industry is no longer just about volume. It is about value, resilience, and sustainability. With record exports, growing sportswear production, and a shift into eco-friendly fabrics, the sector is showing its ability to evolve.

As Cambodia garment export diversifies, the industry not only supports millions of jobs at home but also strengthens its place in global trade. For Cambodia, this is a strategic step toward long-term economic stability.

FAQs

1. How important is the garment sector to Cambodia’s economy?

It contributes over one-third of GDP and around 70% of total exports.

2. What was the value of Cambodia’s garment exports in 2024?

Exports of garments, footwear, and travel goods reached US$13.6 billion.

3. Why is Cambodia focusing on sportswear and sustainable fabrics?

Global brands demand higher-value, eco-friendly products, creating growth opportunities.

4. What challenges does the industry face?

Heavy reliance on imported fabrics, rising costs, and pressure to meet ethical sourcing standards.

5. Which global brands are sourcing more from Cambodia?

Major companies like Nike and Adidas are increasing their orders from Cambodian factories.