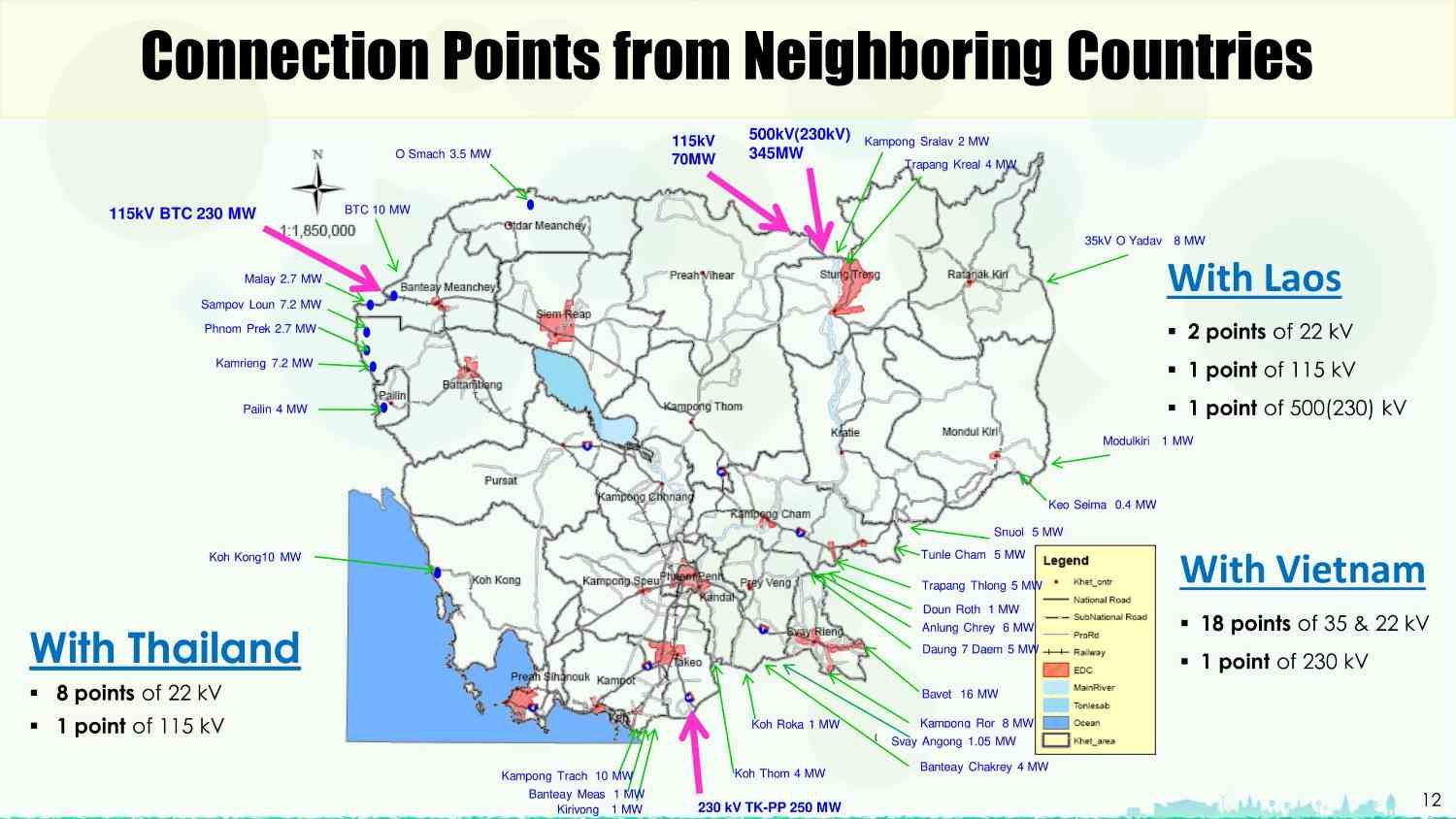

Cambodia’s energy landscape is shifting fast. A key focus of the Cambodia Energy Deal Watch is the government’s plan to import over 600 megawatts (MW) of clean power from Laos, Vietnam, and Thailand within two years. This represents a 50% increase from current levels, signalling a significant shift in Cambodia’s landscape as it strengthens energy security and moves toward renewable energy sources.

At the same time, 23 new domestic power projects worth $5.7 billion have been approved to support national supply and diversify sources. This mix of local investment and cross-border trade is key to meeting Cambodia’s booming electricity demand, which has grown 16% per year since 2009.

Rising Investment, Growing Ambition in Cambodia Energy Deal Watch

Private investment in Cambodia’s energy sector reached $447.5 million in 2023, showing how business confidence in the sector is rising. The private sector is now a core partner in shaping Cambodia’s energy future, not just a background player.

Further momentum came when the Asian Development Bank (ADB) approved an $82.5 million loan in 2025. The funding will help Cambodia reduce coal dependence and push toward its goal of achieving 70% renewable energy in its power mix by 2030. Yet, achieving this in a politically complex region requires more than money. It requires stability and trust among neighbors.

Border Power Politics

That trust is being tested in the Cambodia Energy Deal Watch. Border tensions between Thailand and Cambodia in 2025 have raised alarms for energy planners. Several solar projects and shared grid infrastructure in frontier provinces face disruption risks if the conflict persists.

For Cambodia, such risks are more than local. The country’s energy system is tightly interlinked with its neighbors. Cross-border transmission lines, though limited, are essential. This is especially during droughts or high-demand periods. Any severance could create severe energy shortfalls and undermine years of regional collaboration.

Read Also: Cambodia Border Trade Tensions Rise Due To Ghost Sounds

These tensions highlight the fragile balance between national sovereignty and regional cooperation in Southeast Asia’s power trade. The ASEAN framework encourages integration, but politics often pulls in the opposite direction.

Cambodia Energy Deal Watch: The ASEAN Integration Puzzle

The ASEAN Power Grid (APG) vision aims to connect member states into one electricity network. Progress has been slow but steady. The Lao PDR–Thailand–Malaysia–Singapore Power Integration Project (LTMS-PIP) demonstrated the potential in 2022, transmitting 100 MW of hydropower across borders.

Today, Vietnam and Thailand each export around 1% of their generated electricity, which are modest flows, but vital for regional balance. Cambodia relies on these imports to meet its growing needs, making diplomacy as important as engineering.

Regional Cooperation Under Scrutiny

As ASEAN countries deepen integration, questions arise: who controls what, and who benefits most? For Cambodia, success means keeping doors open to all neighbors while maintaining energy independence.

The current tensions show that energy cooperation is never just about wires and watts. It’s about diplomacy, investment, and national pride — all intertwined. For the ASEAN electricity pact to succeed, trust and transparency must come before trade.

Read Also: Cambodia’s Trade Deal Ambitions Spark New EU Pathways in 2027

Cambodia Energy Deal Watch

As the region pushes toward renewable integration, Cambodia’s balancing act will shape how ASEAN’s power grid evolves. Stakeholders, investors, and policymakers must stay alert.

In this context, Cambodia Energy Deal Watch becomes more than a headline. It’s a call to pay attention to how power, politics, and partnerships intersect. Cambodia’s energy expansion — from the $5.7 billion in new projects to ADB-backed clean energy transitions — stands at a crossroads shaped by both opportunity and risk. To understand these developments or to explore how strategic insights can guide investment and policy, contact Market Research Cambodia, a global advisory firm helping governments and businesses navigate complex energy transitions with clarity and confidence.